Egypt Electric Vehicle Market and Charging Infrastructure: Trends, Growth, and Future Outlook

This report analyzes the current situation, key players, distribution, operators, national policies, and future development trends of Egypt's electric vehicle and charging market. As a significant transportation hub in Africa and the Middle East, Egypt is actively fostering the development of the new energy vehicle industry and aims to become a center for electric vehicle manufacturing and export. Although Egypt's electric vehicle and charging market is still in its early stages, it holds substantial growth potential and is expected to experience rapid expansion in the coming years.

This report analyzes the current situation, key players, distribution, operators, national policies, and future development trends of Egypt's electric vehicle and charging market. As a significant transportation hub in Africa and the Middle East, Egypt is actively fostering the development of the new energy vehicle industry and aims to become a center for electric vehicle manufacturing and export. Although Egypt's electric vehicle and charging market is still in its early stages, it holds substantial growth potential and is expected to experience rapid expansion in the coming years.

Ⅰ.The Current Situation of EV and Chargers in Egypt

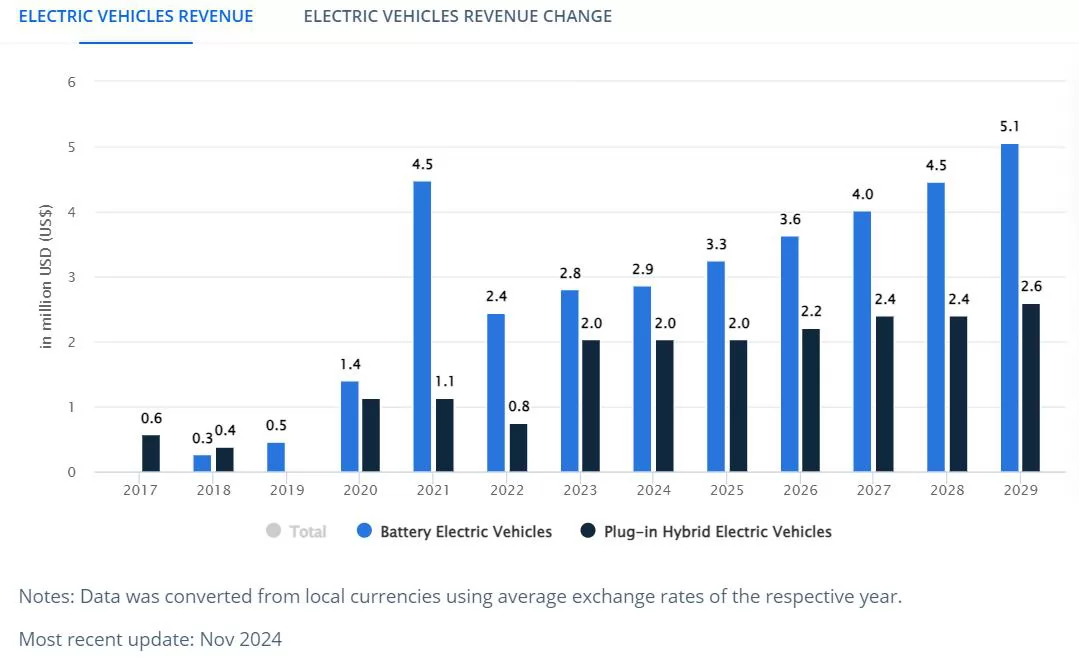

Egypt is a country that heavily relies on fossil fuel imports, which puts pressure on the economy. The government recognizes the need to reduce dependence on fossil fuels and promote sustainable transportation options. To this end, the government has implemented policies and measures to encourage the adoption of battery electric vehicles. This includes tax incentives, Import Tariff exemptions, and subsidies for electric vehicle purchases. By 2025, the expected revenue of Egypt's electric vehicle market will reach $2.90 million. The annual growth rate (compound annual growth rate from 2025 to 2029) of this segment is expected to be 12.05%, and the market capacity is expected to reach $5 million by 2029.

In recent years, the Egyptian government has been continuously promoting the development of the new energy vehicle industry, enhancing the country's potential as a center for electric vehicle manufacturing and export. As of the end of 2023, Egypt's car ownership is about 7.30 million vehicles, with a low penetration rate of electric vehicles but good sales performance. Between 2022 and 2023, Egypt's electric vehicle sales skyrocketed from 900 units to 3,200 units, with Quarter 1 sales exceeding 1,419 units in 2025. By 2029, it is expected that the sales of battery electric vehicles will reach 7,800 units.

Egypt's battery electric vehicle market is showing a significant trend of increasing availability of charging infrastructure. Nowadays, with the widespread deployment of charging stations throughout Egypt, consumers' confidence in the practicality of purchasing battery electric vehicles is growing. Egypt requires every gas station to install EV charger, plans to build 3,000 vehicle charging stations in the next three years, and encourages state-owned enterprises to replace 5% of their fleets with electric vehicles each year. These policies have strongly promoted the development of the EV charger industry. In addition, in September 2025, Shenzhen Jintongyuan Energy Storage Technology Co., Ltd., a subsidiary of Baiyu Holdings, signed a letter of intent for cooperation with Adler International, planning to build 365 charging and swapping stations in Cairo, with a total investment expected to be $547.50 million. The Egyptian government actively provides incentive policies and financial subsidies for charging infrastructure buildings to promote the popularization of electric vehicles, which has effectively promoted this development trend and further consolidated the foundation for the continuous expansion of battery electric vehicles in the Egyptian market.

Ⅱ.Existing electric vehicle and charger brands

Egypt's electric car market features a diverse range of brands, with international players like Tesla, Nissan, BMW, and Volvo holding significant market share. In addition, Chinese brands such as BAIC, Geely, and BYD have entered the market, collaborating with local companies to establish assembly plants and sales networks. These partnerships aim to cater to the varying needs of Egyptian consumers. Moreover, local companies have begun to develop and promote electric vehicles tailored to the specific demands of the Egyptian market.

Regarding charging infrastructure, key suppliers in Egypt's market include global brands like ABB, Schneider Electric, and Enerserve, as well as several local companies specializing in new energy solutions. These companies provide a range of charging equipment, including both fast and slow charging options, to accommodate different user requirements. Additionally, Egypt’s electric vehicle charging network, led by the company Revolta, has partnered with multiple stakeholders to expand the number of charging stations across the country.

III. EV Charger network distribution

Egypt's charging network is gradually improving, mainly distributed in urban centers, transportation hubs, shopping malls, and highway service areas. These charging stations provide convenient charging services for electric vehicle users, promoting the popularity of electric vehicles. In addition, the Egyptian government is actively promoting the construction of charging infrastructure and plans to expand electric vehicle manufacturing plants and charging stations on a large scale in the next few years.

Source: PlugShare

IV. Charging operators

Egypt's electric vehicle (EV) charging sector is rapidly evolving, with key players driving the expansion of charging infrastructure across the country. In addition to major operators like the National Petroleum Service Company and Schneider Electric, several companies are partnering with electric vehicle charging internet platforms to promote the development and operation of charging stations. As the EV market in Egypt continues to grow, more operators are expected to enter the market. Below are the five major companies leading the way in the development of electric stations in Egypt:

1. Plug by Elsewedy Electric

Plug is one of Egypt's leading electric vehicle charging providers, offering a wide range of charging solutions. The company is known for its charging stations, software management systems, and maintenance services. Plug's commitment to supporting electric transportation is evident in its focus on developing a robust, nationwide charging network to meet the growing demand for electric vehicles.

2. TAQA Volt

A subsidiary of TAQA Arabia, TAQA Volt is enhancing Egypt's EV charging infrastructure by collaborating with various partners, including Wadi Degla Development, to build additional charging stations. This effort aligns with Egypt's Sustainable Development Vision 2030, contributing to the country's transition to more sustainable transportation solutions.

3. Infinity-E

Infinity-E, a subsidiary of the renowned energy company Infinity, focuses on the construction of renewable energy and electric vehicle charging stations. Infinity-E is actively working to expand Egypt's charging network, supporting the adoption of electric vehicles while integrating renewable energy solutions into the infrastructure.

4. Sha7en

As a subsidiary of MB Group, Sha7en provides comprehensive charging solutions, including both AC and DC charging stations. The company's goal is to support the growth of electric transportation in Egypt by deploying advanced charging technologies and establishing a nationwide network of charging stations.

5. Volta

Volta specializes in providing user-friendly EV charging solutions for residential areas, commercial facilities, and public spaces. The company focuses on enhancing the user experience and expanding its market coverage, making EV charging more accessible and convenient for a wider audience.

V. Relevant national policies

With the government implementing policies to promote clean energy, the demand for battery electric vehicles in Egypt continues to grow. The Egyptian government attaches great importance to the development of the new energy vehicle industry and has introduced a series of policy measures. Since 2021, the Egyptian government has begun to pay attention to the import of electric vehicles, encourage the use of electric vehicles, and build sound infrastructure for it. In 2022, the Egyptian government launched the national strategy of localizing the automobile industry, and new energy vehicles can enjoy "zero tariff" treatment whether they are imported or locally assembled. In addition, the Egyptian government plans to invest about $1.50 billion to expand the country's electric vehicle manufacturing plants and charging stations.

Preferential tariff policy

• Since 2021, Egypt has implemented a "zero tariff" policy for the import of electric vehicles, while the import of fuel vehicles requires high tariffs to reduce the purchase cost of electric vehicles, improve their market competitiveness, promote the import and popularization of electric vehicles. In the first quarter of 2025, the number of registered electric vehicles in Egypt has increased significantly, with the vast majority of them produced in China.

• Related parts import duty-free: In order to support the development of the local electric vehicle industry, the Egyptian government has also given certain tariff preferential policies for the import of some parts used for electric vehicle production, reducing the production cost of local electric vehicles and helping to promote the localization of electric vehicles.

Industrial development planning and support policies

• In 2022, the Egyptian government launched the strategy and established the Supreme Council of the Automotive Industry led by the Prime Minister to promote the localization of automobile production, especially electric vehicles. The plan is to localize 65% of vehicle parts in the next 3 to 5 years and export the products to the Middle East, Africa, Europe, and Latin America.

• Encourage foreign companies to build factories and put into operation: The Egyptian government actively attracts foreign car companies to build factories and put into operation in Egypt. For example, in 2022, Egypt GV Investment Company reached a cooperation agreement with China FAW Group, planning to start producing affordable electric vehicles from China FAW in Egypt in the first quarter of 2025 to promote technology introduction and industrial upgrading, and drive local employment and economic development.

• The establishment of regulatory agencies and subsidy policies: In July 2023, the Egyptian parliament approved the creation of a new regulatory agency - the Supreme Council for Vehicle Manufacturing, responsible for formulating new policies for the local automotive industry. In 2025, the Egyptian government announced that it will provide subsidies of up to 50,000 Egyptian pounds (approximately $2,500) for the purchase of locally manufactured electric vehicles to encourage consumers to purchase locally produced electric vehicles and enhance the market competitiveness of local brands.

Charging infrastructure building policy

• Accelerate the layout of EV charger: The Egyptian government strongly supports the construction of electric vehicle charging facilities. Since 2020, the number of charging stations has grown rapidly, from 12 at that time to over 1200 today, improving the convenience of electric vehicle use and reducing consumers' "range anxiety".

• The Egyptian government requires every gas station to install EV charger to further improve the charging network and provide more extensive and convenient charging services for electric vehicle users.

Other policies

• Old Car Replacement Initiative: Egypt's President Sisi launched the "Green Travel" initiative in 2021, which includes a focus on replacing cars over 20 years old. This has created more market space for electric vehicles to some extent and promoted their sales.

• Emissions regulations and fuel vehicle bans: Egypt's government has banned traditional gasoline and diesel vehicles from 2040 as part of its Vision 2030 strategy, aiming to reduce greenhouse gas emissions from the energy sector (including oil and gas) by 10% by 2030, strongly promoting the development of new energy vehicles, including electric vehicles.

VI. Future Development Forecast

The growth of Egypt's battery electric vehicle market can also be attributed to favorable macroeconomic factors. In recent years, the country's economy has steadily grown, increasing consumers' purchasing power. Additionally, the government's focus on infrastructure development, including electric stations, has created employment opportunities and stimulated the growth of the electric vehicle industry. In summary, due to the increasing environmental awareness of consumers, the highlighting of the cost-effectiveness of electric vehicles, and the improving electric station network, Egypt's battery electric vehicle market is experiencing significant growth.

In summary, Egypt's new energy electric vehicle and EV charger market has huge development potential and will usher in a period of rapid growth in the future. Chinese car companies and charging operators should seize the opportunity, actively enter the Egypt market, and promote the development of the new energy vehicle industry.

Read more:

Top 10 EV Charger Manufacturers in the USA in 2025

Step-by-Step Guide: How to Install an Electric Car Charging Station

Top 10 EV Charging Companies in the World 2025

The state of EV Charging in the Middle East Region - Anari Energy

You Might Also Like...

-

Overview of the Electric Vehicle and Charging Market in Central Asia

2026 Feb,05 -

Overview of the Australia Electric Vehicle and EV Charging Market

Australia's electric vehicle (EV) market is rapidly expanding, with Tesla leading the high-end segment and Chinese brands like BYD gaining traction among mid-to-low-end consumers.2026 Feb,05 -

List of 60 EV Charging Companies in 2026

EV charging companies are at the forefront of this revolution, driving the transition to sustainable transportation through innovative technologies and expansive networks. Below is a list of 60 leading EV charging companies worldwide in 2026, showcasing the key players shaping the future of mobility.2026 Jan,26