The state of EV Charging in the Middle East Region

As electric vehicles (EVs) become more prominent worldwide, several Middle Eastern countries are emerging as growing markets, with governments pushing for increased EV infrastructure and charging facilities. Here’s a look at the current state of the EV market and charging infrastructure in the UAE, Saudi Arabia, Israel, and other regional countries, highlighting the roles of various EV charging station manufacturers, EV charger suppliers, and EV charging station installation companiesin supporting this shift toward green energy transportation.

Ⅰ、UAE: Pioneering EV Adoption and Charging Infrastructure

The UAE, particularly Dubai, leads the Middle East in EV adoption. By December 2023, Dubai’s EV stock reached 25,929 — a significant number for the region. Supporting this is a network of charging stations aimed at meeting the increased demand. The country had approximately 800 charging stations nationwide by mid-2023, with 620 public charging stations in Dubai by the end of 2022. The Dubai government’s target is to triple charging stations to 1,000 by 2025, ensuring accessibility for EV users and reinforcing the role of EV charging companiesin infrastructure development.

Key players in the UAE’s charging infrastructure include both international and local EV charger manufacturersand EV charger supplierswho provide a range of EV chargers, including AC EV chargers and 22kW DC EV chargers. The UAE is also promoting EV home charging through companies that install at-home systems, such as the Wallbox Pulsar Plusand other leading electric car chargers.

Saudi Arabia: Rapid Expansion of EV Charging Infrastructure

Though Saudi Arabia began developing its EV sector later than the UAE, its growth has been remarkable, thanks to supportive government policies. With the goal to install 100,000 EV chargers by 2025, covering key cities and highways, Saudi Arabia is set to experience a surge in EV charging station manufacturersand EV charging station installation companiescatering to various charging requirements, including DC fast charging stations for quick top-ups on highways.

This focus on infrastructure will also benefit EV home chargerproviders, helping consumers transition to electric vehicles with convenient EV home charging solutions. The rise of electric car charging station companiesis expected to further accelerate Saudi Arabia’s commitment to sustainable transportation.

Israel: Dominance of Chinese EVs and Growing Charging Needs

Israel’s EV market is experiencing rapid growth, particularly with Chinese electric vehicles capturing a substantial portion of the market—61% in 2023and increasing to 68.31% in early 2025. This trend underlines the rising demand for EVs in Israel and the corresponding need for electric car charging stations across the country. Various EV charging station companiesand electric charging station companiesare expanding their presence to serve this growing market, providing advanced AC EV chargers and DC EV chargers suited for both public and private use.

Other Middle Eastern Countries: Gradual EV Growth

Countries like Egypt and Qatar are also entering the EV market, albeit at a slower pace. Egypt’s Electric Vehicle Development Plan, initiated in 2018, outlines a gradual increase in EV market share and charging infrastructure. These markets are beginning to attract EV charging station manufacturersand EV charging installation companiesfocused on introducing EV chargers in key urban areas.

Future Growth in the Middle East

The Middle East's electric vehicle (EV) market is set for significant growth, driven by ambitious governmental goals, international partnerships, and the gradual shift in consumer preferences toward sustainable transportation. This development is creating vast opportunities for EV charger manufacturers, EV charging companies, and EV charging station installation companies. Here’s a closer look at the projected growth across key Middle Eastern countries:

UAE: Projected Market Expansion

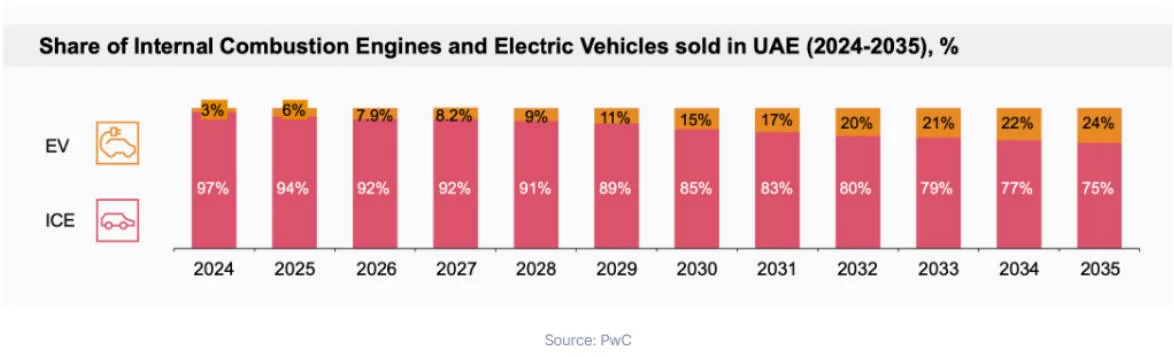

The UAE's EV market is on a fast track to expansion. According to Arthur D. Little, the UAE’s electric vehicle market will grow at an annual rate of 30% from 2022 to 2028. PwC further projects that by 2030, EVs will account for 15% of new passenger and light commercial vehicle sales in the UAE, approximately 58,000 units. By 2035, this share is expected to reach 25%, or around 110,500 units. This growth trajectory emphasizes the need for increased EV charging infrastructure, from EV charging stationsto residential EV home chargers, in order to keep pace with rising demand.

With government support, the UAE's EV infrastructure is expanding, including partnerships with EV charging station companiesto increase the number of public EV chargersand DC fast charging stations. Leading EV charger brands, like Wallbox Pulsar Plus, are becoming popular options for home charging, while EV charger suppliersplay a key role in ensuring a steady supply of advanced AC EV chargers and 22kW DC EV chargers to meet diverse needs.

Saudi Arabia: Aggressive EV Goals

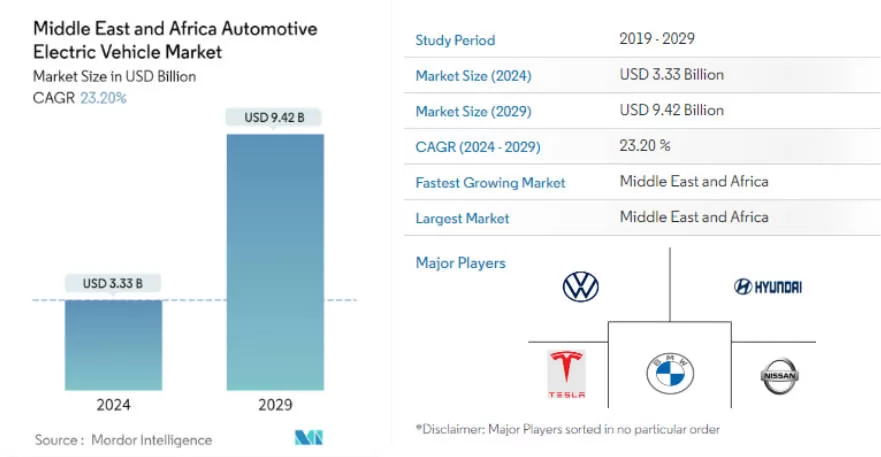

Saudi Arabia has established ambitious targets for EV adoption, with the government expecting substantial market growth. The market size for electric vehicles in the Middle East and Africa is projected to reach $3.33 billion by 2025, and $9.42 billion by 2029, with Saudi Arabia expected to hold a significant share. This rapid growth is supported by major initiatives, such as the construction of extensive EV charging stationsand the development of EV charging station installation companiesto meet the needs of a rising number of EVs on the road.

With these developments, Saudi Arabia will see increased demand for electric car chargersand EV charging companiesoffering a range of products from residential EV home chargers to DC fast charging stations along highways and key urban areas. As more electric car charging station companiesenter the market, Saudi consumers will have access to best-at-home car chargers, fostering a more consumer-friendly transition to EVs.

Israel: Growth Driven by Chinese EV Brands

Israel’s EV market is on an upward trajectory, especially as local consumers increasingly prefer Chinese EV brands. These brands accounted for 61% of the market in 2023 and increased to 68.31% in early 2025. This rising demand is prompting the need for reliable EV charging station manufacturersand electric charging station companiesto establish a robust charging infrastructure throughout Israel.

EV charging installation companiesare expanding across Israel to meet growing demand, while EV charger manufacturersare providing electric car chargers suitable for both public and home use. With a focus on efficiency, AC EV chargers and 22kW DC EV chargers are becoming more popular, ensuring that Israeli EV drivers have access to top-tier electric car charging stations.

Other Middle Eastern Countries: Qatar and Egypt

Qatar aims to reach a 10% pure electric vehicle penetration rate by 2030 and is planning to expand to 15,000 charging stations, driving the development of its EV market. Egypt, too, is on a promising path, with active government support aimed at boosting EV adoption. Both countries are setting the stage for growth in EV charging companies, EV charging station manufacturers, and electric car charging companiesto serve their emerging EV markets.

Although the current infrastructure for EV chargers in the Middle East is relatively underdeveloped, there is immense potential for growth. As regional governments actively support the EV sector, EV charger suppliersand EV charging installation companieshave a unique opportunity to tap into a rapidly expanding market. The shift toward sustainable energy transportation is anticipated to drive up the demand for EV chargers, from EV home chargers to DC fast charging stations across the region.

II. Incentive policies of various countries

As various nations aim to reduce carbon emissions and foster sustainable development, many have implemented specific incentive policies for electric vehicles (EVs). This overview covers the EV-related policies of the UAE, Saudi Arabia, Egypt, and Qatar, each aiming to accelerate the adoption of EVs, charging infrastructure, and support from EV charger manufacturers and suppliers.

United Arab Emirates (UAE)

The UAE is taking significant steps to establish a green transport infrastructure through the National Electric Vehicle Policy. Key targets include:

Government Vehicle Conversion: By 2030, 30% of government department vehicles and 10% of all road vehicles (both electric and hybrid) are targeted to be electric. By 2050, 50% of all UAE road vehicles will be electric.

Charging Infrastructure Development: Efforts to expand EV charging stations across Dubai and other major areas are underway. The UAE is focusing on building green charging stations and improving EV charging station companies to support the rapid charging needs of users.

To cater to these goals, the UAE encourages partnerships with EV charger manufacturers and electric car charging companies to install a range of options, including Wallbox Pulsar Plus home chargers, AC EV chargers, 22kW DC EV chargers, and DC fast charging stations. The country is also exploring ways to enhance its EV charging installation companies or seamless infrastructure growth.

Saudi Arabia

Saudi Arabia’s Vision 2030 incorporates significant measures to promote EV adoption, leveraging policies within the National Transformation Plan:

Incentives for EV Use: Saudi Arabia provides various benefits, including tax incentives, free parking, free charging, and priority passage for EVs.

Safety and Quality Standards: The country has developed regulations and specifications to ensure high standards for EVs and EV charging stations.

Expansion of Charging Stations: Saudi Arabia aims to establish 100,000 charging stations by 2025 across major cities and highways. This expansion will involve EV charger suppliers and EV charging station manufacturers, encouraging private-sector investments.

Egypt

Egypt launched its Electric Vehicle Development Plan in 2018 to bolster the EV market:

EV Adoption Goals: Egypt aims to have EVs represent 2% of the vehicle population by 2025 and 10% by 2030.

Incentives and Support: The Egyptian government offers subsidies for EV purchases, tax relief, and significant investment in charging station infrastructure.

Support for Charging Infrastructure: Egypt’s EV infrastructure development plan includes working with EV charger manufacturers and EV home charger suppliers to increase accessibility and convenience. Egypt is particularly focused on ensuring adequate AC EV chargers and 22kW DC chargers to support urban and residential areas.

Qatar

Qatar has established ambitious EV policies with a strong focus on public transportation electrification and EV infrastructure:

Electric Vehicle Goals: Qatar targets a 10% EV penetration rate by 2030 and aims for 100% electric buses for public transportation.

Charging Station Expansion: The country plans to develop 15,000 charging stations, providing policy and financial support to companies involved in EV charging station installation and electric car charger manufacturing.

Qatar’s strategy includes financial incentives for EV charging station manufacturers and electric car charging companies to facilitate the installation of advanced DC fast charging stations. This support structure will allow users to benefit from EV home chargers and Wallbox Pulsar Plus units, and create a more integrated EV charging network.

III. EV Charger and electric vehicle brands in the Middle East

1.International brands

Tesla: As a leading global electric vehicle brand, Tesla has a high reputation and market share in the Middle East. Its products have advanced technology, long range, and excellent performance, which have been recognized by local consumers. For example, Tesla's Model S, Model 3 and other models have good sales in the Middle East.

BMW: BMW is one of the earliest traditional luxury car brands to enter the field of electric vehicles, and its electric vehicle products also have a certain market share in the Middle East. BMW's electric vehicles focus on the combination of driving performance and luxury, with strong brand influence and certain appeal to high-end consumers in the Middle East.

Nissan: Nissan's electric vehicles also have a certain market share in the Middle East, and its Leaf model is one of the highest-selling electric vehicles in the world. Nissan's electric vehicles have certain advantages in technology and performance, and are relatively affordable, suitable for mass consumers.

2.Chinese brands

BYD: BYD has a strong development momentum in the Middle East, and has already launched business in countries such as the UAE, Saudi Arabia, Jordan, Qatar, and Israel. The first store in Riyadh, the capital of Saudi Arabia, officially opened in May 2025, and completed the 1000th delivery in the UAE in June, establishing its leading position as an electric vehicle brand. BYD's electric vehicle products have high cost performance, rich configurations, and reliable performance, and are favored by Middle Eastern consumers.

Geely: Geely's electric vehicle brand, such as Jike Auto, has signed national-level general agency agreements with UAE, Saudi Arabia, Qatar, and Bahrain dealers to jointly build a sales and service network. Geely's electric vehicle products have certain competitiveness in design and technology, and the brand influence is also constantly improving.

Other Chinese brands such as Great Wall, BAIC, Changan, Xiaopeng, Skyworth and other Chinese electric vehicle companies have also entered the Middle East market, gradually occupying a place in the electric vehicle market in the Middle East with high cost performance and continuously improving product quality.

3.Local brands

Turkey's TOGG: Turkey's first electric vehicle manufacturer, with the first regular model priced at around 350,000 RMB. With the support of the Turkish government, TOGG is actively developing the local electric vehicle industry and is expected to gain a certain market share in the domestic market and surrounding areas of Turkey in the future.

Saudi Arabia's local brands: The Saudi government is also actively promoting the development of the local electric vehicle industry. In the future, there may be some local electric vehicle brands to meet the needs of the local market.

The electric vehicle (EV) charger market in the Middle East is rapidly developing. Some globally renowned brands and local companies are actively expanding the charging infrastructure in the Middle East. The following are the main ev charger brands in the region.

International brands

1.ABB

Swiss-Swedish company ABB provides charging solutions worldwide and is a major supplier of many public and private charging stations in the Middle East. Its ev charger products include fast charging and ultra-fast charging equipment, which are widely used in countries such as the UAE and Saudi Arabia.

2.Schneider Electric

France's Schneider Electric has launched multiple electric vehicle charging stations in the Middle East market, covering both residential and commercial charging stations, featuring intelligence and energy efficiency, to meet the infrastructure needs of the Middle East region.

3.Siemens

Siemens has launched charging solutions suitable for homes, businesses, and highway service areas in the Middle East, especially fast charging and DC charger, which are widely distributed in the UAE, Saudi Arabia, and Qatar.

4.Tesla Supercharger

Tesla has a network of supercharging stations in the UAE and Saudi Arabia, mainly serving Tesla owners and providing a fast charging experience. The network is constantly expanding.

5.EVBox

EVBox, a Dutch company, has entered the Middle East market, providing a diverse range of charging station equipment for home, commercial, and public use, supporting remote management and billing systems.

Local brands

1.DEWA Green Charger (Dubai Electricity and Water Authority)

The Dubai Electricity and Water Authority (DEWA) has launched the Green Charger project in Dubai, which is specifically designed to install charging piles in local public and private parking lots, shopping centers, gas stations, and other places to support the popularization of electric vehicles in Dubai.

2.Electromins (Saudi Arabia)

Electromin is a local charging service provider in Saudi Arabia, dedicated to building a nationwide charging network covering slow and fast charging services. The company is collaborating with multiple international companies to expand its network throughout Saudi Arabia.

3.Emicool (UAE)

Emicool is a UAE-based cooling company that also provides electric vehicle charging stations, especially in Abu Dhabi and Dubai, to support electric vehicle owners in residential areas and commercial centers.

4.Fasenergy (Saudi Arabia)

Fasenergy is a Saudi Renewable Energy company that provides installation and management of electric vehicle charging stations and plans to expand to various parts of the country in the coming years.

Other brands entering the Middle East

1.ChargePoint

ChargePoint provides commercial and public charging solutions in some UAE and Qatar regions, especially in commercial work buildings and shopping centers.

2.Blink Charging

Blink Charging has partnered with local partners in the Middle East to launch multiple charging stations, particularly in tourist and commercial areas.

3.Tritium

Australia's Tritium provides high-speed DC charging station equipment in the Middle East market, suitable for places such as fast charging stations, shopping malls, and highway rest areas.

These brands are expanding their charging networks in major cities and business districts in the Middle East to meet the growing demand for electric vehicles.

Distribution of charging network

The Middle East is rapidly advancing its electric vehicle (EV) infrastructure, particularly the EV charging station network. Government incentives and consumer demand for environmentally friendly travel are driving the expansion of EV charging networks across the region. This article discusses the current status of charging networks in the UAE, Saudi Arabia, Israel, Egypt, and Qatar, highlighting opportunities and challenges as the region works to increase the availability of EV chargers from both local and international EV charger manufacturers and EV charging companies.

United Arab Emirates (UAE)

The UAE, especially Dubai, is at the forefront of charging infrastructure development:

Comprehensive Network in Dubai: Dubai’s public charging network is relatively advanced, thanks to initiatives by the Dubai Water and Electricity Authority to promote green charging stationsand expand EV charging station coverage. EV charging installation companies are key to meeting demand, particularly in urban centers where electric vehicles are increasingly popular.

Challenges in Remote Areas: While the charging infrastructure in Dubai’s urban areas is robust, EV chargers are less prevalent in remote and newly developed regions. To address this gap, Dubai’s focus includes collaborating with EV charging station manufacturers and EV charging station installation companies to ensure more widespread access.

Growth in EV Charger Variety: UAE’s charging options include Wallbox Pulsar Plus, AC EV chargers, and 22kW DC EV chargers, suitable for home EV chargers as well as high-speed options in public locations.

Saudi Arabia

Saudi Arabia is heavily investing in its EV charging network as part of its Vision 2030 goals:

Rapid Expansion Goals: Saudi Arabia plans to deploy 100,000 EV chargers nationwide by 2025, targeting major cities like Riyadh and highway routes. The current charging station network is still developing, with a focus on comprehensive coverage in the next few years.

Increase in Major Cities: Major cities such as Riyadh have seen a steady increase in electric car charging stations, but DC fast charging stations are needed to meet the expected demand.

Opportunities for Charger Manufacturers: The expansion provides opportunities for EV charger suppliers and EV charging installation companies to meet growing demands, with EV charging station companies investing in high-speed charging and Israel’s EV market is growing, and its charging infrastructure is evolving to meet this demand:

Urban Focus on Charger Installation: Israel has developed electric car charging stations in major cities and transportation hubs to cater to the increasing number of EVs. However, rural and remote areas lack sufficient charging infrastructure.

Charging Network Challenges: Israel’s network expansion opens avenues for EV charger manufacturers and electric charging station companies to introduce innovative solutions, such as 22kW DC EV chargers and best at-home car chargers, ensuring accessibility across urban and rural areas.

Egypt and Qatar

Other Middle Eastern countries, including Egypt and Qatar, are steadily advancing their charging network infrastructures:

Egypt: The Egyptian government is dedicated to investing in charging station infrastructure to support the growth of EV adoption. EV charging station manufacturers and EV charging station installation companies are encouraged to contribute to the expanding network, which includes options like AC EV chargers and DC fast charging stations to accommodate diverse EV needs.

Qatar: Qatar is working toward an ambitious goal of 15,000 charging stations to facilitate electric car charger access by 2030. This includes partnerships with EV charging companies and EV home charger suppliers to ensure a robust charging infrastructure for both public and private EV use.

Challenges and Future Directions

The EV and EV charger markets in the Middle East are expanding rapidly, with significant government support and rising consumer demand. However, several challenges must be addressed to ensure sustained growth:

Infrastructure Gaps: Many remote and newly developed areas still lack sufficient charging infrastructure, especially high-capacity DC fast charging stations for long-distance EV travel. This presents opportunities for electric car charging companies and EV charging station installation companies to bridge the gap.

Market Competition: The EV market faces fierce competition as EV charger suppliers and electric charging station companies for dominance, highlighting the need for innovation and competitive pricing to meet consumer expectations.

Public-Private Partnerships: Middle Eastern governments are increasingly encouraging private-sector participation in charging network expansion. Collaborating with EV charging station companies and electric car charging companies can accelerate network growth and improve EV home charger access.

In the coming years, Middle Eastern countries will likely strengthen regional cooperation and partner with global EV charging companiesand charging station manufacturers. This collaboration will be essential to achieving a well-distributed, reliable charging network that supports the widespread adoption of electric vehicles across the region.

For EV owners seeking a reliable, fast-charging solution, Shenzhen Anari Energy Co., Ltd. offers a standout option. Their DC EV Charger is designed to deliver rapid, efficient charging, making it ideal for commercial and public applications. With high power output, Anari Energy’s DC charger significantly reduces charging times, ensuring that EVs are back on the road quickly and minimizing downtime for drivers.

The charger is not only powerful but also built for durability, providing consistent performance even with frequent use. Compatible with a wide range of EV models, it offers flexibility and convenience for mixed fleets and diverse user needs. A user-friendly interface further simplifies operation, making the charging experience seamless. For areas with high EV traffic and growing demand for fast, reliable charging, Shenzhen Anari Energy’s DC EV Charger provides a smart, effective solution to support the expanding EV market.

You Might Also Like...

-

Overview of the Electric Vehicle and Charging Market in Central Asia

2026 Feb,05 -

Overview of the Australia Electric Vehicle and EV Charging Market

Australia's electric vehicle (EV) market is rapidly expanding, with Tesla leading the high-end segment and Chinese brands like BYD gaining traction among mid-to-low-end consumers.2026 Feb,05 -

List of 60 EV Charging Companies in 2026

EV charging companies are at the forefront of this revolution, driving the transition to sustainable transportation through innovative technologies and expansive networks. Below is a list of 60 leading EV charging companies worldwide in 2026, showcasing the key players shaping the future of mobility.2026 Jan,26